As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

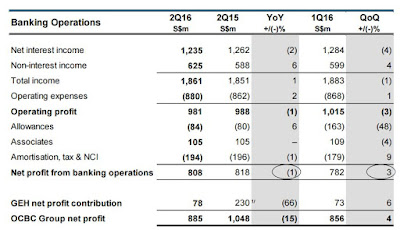

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

|

| We can see that there is a great drop of 66% in Great Eastern profits contribution from last year. Shall not covers more about why Great Eastern profits drop since the concern here is about OCBC. |

Next is we need to know how much is OCBC's insurance arm's weightage.

|

| Insurance's weight at about 11% |

To 穷小子's simplest way of understand is that 11% of OCBC value will be totally wiped off if only there is a worst case scenario for Great Eastern. Guess that OCBC should be able to survive it, but of course, we are still far from seeing this to happen.

Next up to the concern in trend would be the Oil and Gas exposure.

|

| 6% of total customer loans |

Coming up next will be the exposure to the Brexit effects.

|

| Less than 3% of total assets |

Last but not least, let's look into the what 穷小子 interest in most, the dividend payout.

|

| Maintained dividend of $0.18 per share |

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

No comments:

Post a Comment