Starhub FY 2016 results was released last evening. Disappointed results indeed, and seems worse than M1. This shall be a short post with no fancy charts or iconic pictures. 穷小子 had no mood to elaborate further but will not sugar-coat the results.

If you had followed 穷小子 throughout, you must have known that 穷小子 had bought the telcos at early 2015, which is around the all time high and is one of the bad moves. Mainly due to the greed on the attractive dividends yield at that time, and no patience. 穷小子 is not trying to bad-mouth the company but serve more of a reminder to himself. Do remember that he is affected as well.

Total telcos shares holdings is about 29.71% of the total portfolio , and among this telcos shares holdings, Starhub is holding at about 47.68% as of yesterday.

In summary, YoY results:

Total revenue, down 2%

EBITDA, down 3%

Net Profit after Tax, down 8%

FCF / Fully Diluted Share, down 15%

More disappointed at the QoQ results:

Total revenue, Non significant changes

EBITDA, down 14%

Net Profit after Tax, down 33%

FCF / Fully Diluted Share, down more than 300%

Most disappointed will be on the dividends.

FY 2016 will be maintained at $0.05 per quarter, but intend to pay a quarterly dividend of $0.04 per quarter for FY 2017.

Moving forward, 穷小子 will not panic sell, but plan to average down slowly whenever possible.

The attractiveness for this stock gets dimmer as the forecast payout for FY 2017 will be at $0.04 per quarter, $0.16 per year, a 20% cut. This greatly change the stories for 穷小子on Starhub, for all the reasons which he bought in the first place.

Next step will be work hard, save more, and build more warchest. The telco industry in Singapore will going to be a long cold war. Embrace for a sell down on Monday, but who knows how Mr Market may react irrationally again.

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Showing posts with label financial results. Show all posts

Showing posts with label financial results. Show all posts

Saturday, 4 February 2017

Wednesday, 18 January 2017

CapitaLand Commercial Trust (CCT) FY 2016 Financial Results

CCT released their FY 2016 Financial Results this morning. Seems a strong results for 2016 overall per se. 穷小子 shall touch on some of the key factors.

Starting off with the much anticipated on CapitaGreen contributions injections to the portfolio. Note that its contributions is 100% only from 01 Sep 2016 onwards, so expecting the 11% to grow continuously for its full contributions in FY 2017. This will be a good news for investors, and if remember correctly, CapitaGreen was funded internally by CCT, with no rights issued that time.

Portfolio was up by 13.6% YoY, and again mainly due to the increased stake in CapitaGreen.

Debt maturity are evenly spread for the next 6 years with 38% matured on FY 2020. Once again, S$890M (27%) are due to the increased stake in CapitaGreen.

CCT did measures to curb the interest rate hikes effects. Only 20% of the borrowings are on Floating Rate.

Despite oversupply of offices for past few years, CCT is able to consistently above market occupancy, ending the last quarter of 2016 with 97.1% against 95.8%.

Although there is a dipped of 0.2% in the last QoQ, it has been an impressive increasing for the past 17 quarters consecutively.

Well spread of portfolio lease expiry although with majority on 2019. 25% and 7% for Office and Retail respectively.

Every investors' favourite, including 穷小子 too. Income, Assets, DPU and NAV increasing consistently over the years. As Peter Lynch stated in "Beating the Street", "The dividend is such an important factor in the success of many stocks that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 or 20 years in a row."

Sounds logical.

CCT's portfolio committed an impressive occupancy rate of above 90% consistently for the past 10 years. If omitted the 94.8% in 2009 which is due to Global Financial Crisis, technically speaking should above 95% consistently.

Maybe 穷小子 is bias and a bit of exaggerating in this review because this is the highest holdings REITs stock in his portfolio, but an impressive 10 years track records doesn't lies.

穷小子's concludes that this can be one of the "safe" stock for now until 2019 and 2020, the year which has the most portfolio lease expiry and the highest debt maturity amongst respectively. 穷小子 believes that the management will take necessary measures when the time are nearer.

|

| CapitaGreen's contributions is 100% with effect from 01 Sep 2016 |

|

| Portfolio up by 13.6% YoY |

|

| Debt Maturity |

|

| Borrowings |

|

| Portfolio Occupancy rate |

|

| Monthly average office rent |

|

| WALE |

|

| Consistently delivery value |

Sounds logical.

|

| Consistently above 90% |

Maybe 穷小子 is bias and a bit of exaggerating in this review because this is the highest holdings REITs stock in his portfolio, but an impressive 10 years track records doesn't lies.

穷小子's concludes that this can be one of the "safe" stock for now until 2019 and 2020, the year which has the most portfolio lease expiry and the highest debt maturity amongst respectively. 穷小子 believes that the management will take necessary measures when the time are nearer.

Wednesday, 19 October 2016

M1 Third Quarter 2016 Results

M1 share price plunged 5.15% today, a $0.12 drop, to $2.21 today. This is much expected from the poor 3Q16 results released yesterday.

穷小子 mentioned in the previous post that M1 is having a juicy dividend yield of 6.38%, but because of fourth telco is approaching, patience prevails, and still waiting at the sidelines. Take a quick look on the 3Q2016 results.

Key Financial Highlights

穷小子 mentioned in the previous post that M1 is having a juicy dividend yield of 6.38%, but because of fourth telco is approaching, patience prevails, and still waiting at the sidelines. Take a quick look on the 3Q2016 results.

Key Financial Highlights

|

| Operating Revenue $277.6m to $249.1m, -10.3% |

|

| Cost of sales for 9 months $380.9m to $294.6m, -22.7% |

|

| Net Profit after tax $44.9m to $34.4m, -23.4% |

|

Cash & Cash equivalents, -62.9%

Net debt. 20.5%

Net debt/EBITDA, 24.8%

EPS, -12.0%

All these financial leverage are statistically bad.

|

Enough of the current statistic facts, let's see the good side of it.

As we all have known, majority of Singapore's consumers are bounded by the traditional 2 years contracts. Hence, the customer base is one of the most important factors to estimate the future, which at least how 穷小子 think.

Key Performance

Well, at least its 2 main business pillars', mobile and fixed services, base are increasing, at least at a slow pace.

Conclusion

Based on today closed price, the yield is about 6.9%, but of course, pretty much expecting a heavy cut to the dividends. Cut by how much is the big question for a dividend stock.

The management outlook are estimating a decline in FY2016 net profit after tax to be around the year-to-date range.

Assuming there will be a drop of 16% in EPS for FY2016, and the payout policy remains at 80%, we may be having a dividend of 12.8 cents for the next FY.

穷小子 is expecting few bad news to happen which can really hurt M1's share price deeply.

- News of fourth telco

- FY2016 results

- Cut in dividend

- Finally the completion of fourth telco (depending)

Hence not intending to average down in the near future. The first step which 穷小子 will be taking would be either wait for the price to hit at least $2.00 (psychological level), or after the fourth telco decision announced. Depends on whichever earlier.

As we all have known, majority of Singapore's consumers are bounded by the traditional 2 years contracts. Hence, the customer base is one of the most important factors to estimate the future, which at least how 穷小子 think.

Key Performance

|

| Mobile Customer base |

|

| Mobile Market Share |

|

| Fixed services Customer base |

Conclusion

Based on today closed price, the yield is about 6.9%, but of course, pretty much expecting a heavy cut to the dividends. Cut by how much is the big question for a dividend stock.

The management outlook are estimating a decline in FY2016 net profit after tax to be around the year-to-date range.

Assuming there will be a drop of 16% in EPS for FY2016, and the payout policy remains at 80%, we may be having a dividend of 12.8 cents for the next FY.

穷小子 is expecting few bad news to happen which can really hurt M1's share price deeply.

- News of fourth telco

- FY2016 results

- Cut in dividend

- Finally the completion of fourth telco (depending)

Hence not intending to average down in the near future. The first step which 穷小子 will be taking would be either wait for the price to hit at least $2.00 (psychological level), or after the fourth telco decision announced. Depends on whichever earlier.

Lastly, bear in mind that the worst fearful concern is that, there is still no confirmation about a fourth telco yet, there is not even a first step made by the fourth telco, but M1 profits is already dropped hard. Imagine what can this fourth telco do more hurting if it realised.

P.S. 穷小子 is not spreading fear here. M1 is about 10.9% of his total portfolio now.

P.S. 穷小子 is not spreading fear here. M1 is about 10.9% of his total portfolio now.

Wednesday, 3 August 2016

OCBC 2Q2016 Financial Results

To be a better value investor, first of all, should at least know how to analyst a financial results.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

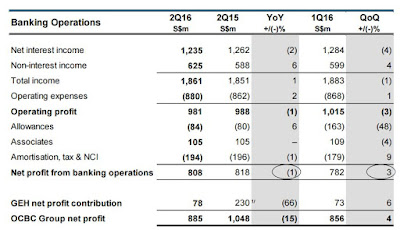

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

Next is we need to know how much is OCBC's insurance arm's weightage.

Next up to the concern in trend would be the Oil and Gas exposure.

Total exposure to Oil and Gas is S$14.3b, and out of which, the customer loans is only at 6%. If 穷小子 remember correctly, the CEO did says that this is negligible during the last AGM. At least there is no exposure to Swiber.

If only to put UK into account, it is only about 2.2% of total assets, which is negligible as well.

Was expecting to have a better payout ratio of at least 40% and a higher dividend at about $0.37-$0.38 for last year, but too bad. Well, at least they did increase the payout ratio for this time round, and didn't cut the dividend. Give and take for this.

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

|

| We can see that there is a great drop of 66% in Great Eastern profits contribution from last year. Shall not covers more about why Great Eastern profits drop since the concern here is about OCBC. |

Next is we need to know how much is OCBC's insurance arm's weightage.

|

| Insurance's weight at about 11% |

To 穷小子's simplest way of understand is that 11% of OCBC value will be totally wiped off if only there is a worst case scenario for Great Eastern. Guess that OCBC should be able to survive it, but of course, we are still far from seeing this to happen.

Next up to the concern in trend would be the Oil and Gas exposure.

|

| 6% of total customer loans |

Coming up next will be the exposure to the Brexit effects.

|

| Less than 3% of total assets |

Last but not least, let's look into the what 穷小子 interest in most, the dividend payout.

|

| Maintained dividend of $0.18 per share |

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

Subscribe to:

Comments (Atom)