Starhub FY 2016 results was released last evening. Disappointed results indeed, and seems worse than M1. This shall be a short post with no fancy charts or iconic pictures. 穷小子 had no mood to elaborate further but will not sugar-coat the results.

If you had followed 穷小子 throughout, you must have known that 穷小子 had bought the telcos at early 2015, which is around the all time high and is one of the bad moves. Mainly due to the greed on the attractive dividends yield at that time, and no patience. 穷小子 is not trying to bad-mouth the company but serve more of a reminder to himself. Do remember that he is affected as well.

Total telcos shares holdings is about 29.71% of the total portfolio , and among this telcos shares holdings, Starhub is holding at about 47.68% as of yesterday.

In summary, YoY results:

Total revenue, down 2%

EBITDA, down 3%

Net Profit after Tax, down 8%

FCF / Fully Diluted Share, down 15%

More disappointed at the QoQ results:

Total revenue, Non significant changes

EBITDA, down 14%

Net Profit after Tax, down 33%

FCF / Fully Diluted Share, down more than 300%

Most disappointed will be on the dividends.

FY 2016 will be maintained at $0.05 per quarter, but intend to pay a quarterly dividend of $0.04 per quarter for FY 2017.

Moving forward, 穷小子 will not panic sell, but plan to average down slowly whenever possible.

The attractiveness for this stock gets dimmer as the forecast payout for FY 2017 will be at $0.04 per quarter, $0.16 per year, a 20% cut. This greatly change the stories for 穷小子on Starhub, for all the reasons which he bought in the first place.

Next step will be work hard, save more, and build more warchest. The telco industry in Singapore will going to be a long cold war. Embrace for a sell down on Monday, but who knows how Mr Market may react irrationally again.

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Showing posts with label mistakes. Show all posts

Showing posts with label mistakes. Show all posts

Saturday, 4 February 2017

Friday, 3 June 2016

Sold off Noble after 5 years.. Finally!!

Sold off my Noble after holding for more than 5 years.. Finally!! Have mentioned before that this is one of the few major bad decisions which were made so far. Well, the price which I bought was at $2.16 to be exact, with 3000 shares. In another words, I just write off a huge 88% loss, more than $5,000 from my portfolio today. This post shall and must be parked under "Mistakes" category to remind myself about it. It is really an expensive and painful mistake indeed.

Made a series of bad decision in this actually:

Honestly, to begin with, I can't even remember why this was bought in the first place. Based on Yahoo finance, $2.16 is very near the all-time high of $2.51, which was somewhere around 2008.

Didn't read any of its financial reports at that point of time. It was bought purely with guts feel, speculations and gambling style. Another minor factor is I don't wish to miss the price, afraid that it may goes higher.

Speculates and gamble. Impatient.

When the price began to drop to a low of $1.05 by the end of 2011, a naive decision was made. Can't remember much clearly again, but the decision to hold onto it was much based on the price movement. Since it came down from a high of $2.84(est.) to a low of $0.47 (est.) in 2008 and managed to come back to a $2.34(est.) in 2011. I was just hoping the same would happened this time.

I truly understand what is "history doesn't tells you the the future" means now.

The price was ranged around $0.81 to $1.44 from 2011. I didn't pay much attention in Noble during this period, just hold it and hoping that the price could reach $2 one day.

False hope.

When the reports by Iceberg Research and Muddy Waters in 2015, that is point when I start to take note about this stock again. Yet I didn't study their report again but only by reading the reports from Iceberg Research and Muddy Waters, and their target price was $0.10. Perhaps I'm in a denial stage at this point of time. Only thinking that since have already suffered from more than 50% loss in this, how much can it gets worse. The price shall recovers once this incident cleared. All these are just noises in the market, and Noble had rejected all of these allegations after all.

Nobody would admits even though if the allegations are true right?

When Noble's CEO unexpectedly announced that he will resigned due to family reasons earlier this week, this is the time when I am finally awakes. It was too late, the price was at $0.30, already incurred a 85% paper loss. I am waiting for a better price to get out this time.

Paper loss should be considered as a loss too

Today Noble Group founder and Chairman announced to step down within 12 months. Noble also said it would cut headcount and together with rights issue announcement:

- 1 Rights Share for every 1 share in Noble Group held, issued at SG$0.11 per share, representing a discount of approximately 63% to the closing price of SG$0.300 per share on the Singapore Stock Exchange on 2nd June 2016, being the last trading day of the Noble Group shares prior to the announcement of the Rights Issue, and a discount of approximately 46% to the theoretical ex-rights price of SG$0.205 per share.

I finally make the decision based on facts and not emotions this time:

First of all, feels so cheated. The announcement of CEO's resigns on 4 days ago actually says that Mr Richard Elman will continue in his role as chairman and executive director. Excuse me. Continues his role for another 4 days only?

Secondly, the way I see from Noble's rights issue announcement, Noble is using their last resort to save the company. They are still in US$3.97 billion net debt (as of 31 Dec 2015), despite raising US$2 billion within the next 12 months.

- The rights issue, together with the sale of Noble Americas Energy Solutions (“NAES”) announced last Monday and the previously announced sale of low return assets and working capital reduction measures will, in aggregate, generate US$2 billion in additional liquidity over the next 12 months

Noble's decision to rights issue is an ultimatum for me to hold on to Noble shares. 穷小子 will not throw any more money into it for the rights issue. $330 is not a huge amount, but that would be about 42% of the current holding Noble shares value, based on the closing price at $0.26 today. A drop to the current $0.26 is about 88%, and to have it back to the $2 days needs about 800%. What are the chances here? Hence made the sell call, take the loss and move on. If the price miracle-ly goes up, then so be it. It is just another unlucky if this really happens.

A series of bad mistakes had resulted in 穷小子 to suffer a hefty loss of at least $5,000, it may not be a lot to others, but this is definitely be the price that 穷小子 gonna pay.

Tuesday, 10 May 2016

Should we rush to buy a stock when everybody is buying it?

From time to time, people made mistakes in investing, and myself is not spared from it as well. One of the common mistakes is one tends to buy the stock although the price keeps going up.

Maybe he want to get a slice of the cake which everybody is rushing towards. Maybe decision affected by families or peers when all are recommending it. Or maybe the reason can even be just because he is attached to this stock emotionally. Whatever the reasons it is, we should try our best not to buy it when the price keep going up, or at least this is what I believed in now. Most of the time, the stocks are already overpriced in such cases. It is not wrong by do so, but must do your homework well before making the buy call.

One good example for myself is that I bought Starhub during early of 2015, at around $4.1x. Main reason I bought this stock is because of the dividend yield, quarterly dividend pay out and payout ratio of 90% based on the the past records. The down point is that my dividend yield is slightly less than 5% only, which is consider as low for a dividend stock, but the price had always been more than $4 since 2013. With the psychological effects upon myself, I assumed it would be safe since it had been hovering around $4+ since 2013, but soon after, the price was heavily impacted by the news of the entrant of a fourth telco in Singapore telecom market.

A similar case which I seeing now is SATS. Will it be a multi-baggers stock in the future, or will it become a "trap"? Time will tell, especially when the opening for Terminal 4 & 5 of Changi Airport.

This lead me to have a thought.

Why would there have a long queue at the chicken rice stall? The price keep increasing but the queue only gets longer. Would you follow the queue blindly to get a packet of the chicken rice just because the queue was long? Is the chicken rice nice, or is it still as nice as before? Was the chicken rice over-priced? Or was it because it is the new "in" thing in town?

Of course, may not be neccessary a chicken rice, it's just an example. Ice-cream may work the trick too. ^-^

#chickenricetheory

Ps. I am still holding my Starhub shares, hoping that there would not be a decrease in the dividend payout. *finger crossed*

Maybe he want to get a slice of the cake which everybody is rushing towards. Maybe decision affected by families or peers when all are recommending it. Or maybe the reason can even be just because he is attached to this stock emotionally. Whatever the reasons it is, we should try our best not to buy it when the price keep going up, or at least this is what I believed in now. Most of the time, the stocks are already overpriced in such cases. It is not wrong by do so, but must do your homework well before making the buy call.

One good example for myself is that I bought Starhub during early of 2015, at around $4.1x. Main reason I bought this stock is because of the dividend yield, quarterly dividend pay out and payout ratio of 90% based on the the past records. The down point is that my dividend yield is slightly less than 5% only, which is consider as low for a dividend stock, but the price had always been more than $4 since 2013. With the psychological effects upon myself, I assumed it would be safe since it had been hovering around $4+ since 2013, but soon after, the price was heavily impacted by the news of the entrant of a fourth telco in Singapore telecom market.

A similar case which I seeing now is SATS. Will it be a multi-baggers stock in the future, or will it become a "trap"? Time will tell, especially when the opening for Terminal 4 & 5 of Changi Airport.

This lead me to have a thought.

Why would there have a long queue at the chicken rice stall? The price keep increasing but the queue only gets longer. Would you follow the queue blindly to get a packet of the chicken rice just because the queue was long? Is the chicken rice nice, or is it still as nice as before? Was the chicken rice over-priced? Or was it because it is the new "in" thing in town?

Of course, may not be neccessary a chicken rice, it's just an example. Ice-cream may work the trick too. ^-^

#chickenricetheory

Ps. I am still holding my Starhub shares, hoping that there would not be a decrease in the dividend payout. *finger crossed*

Wednesday, 27 April 2016

Patience

After I believed in Value investing, it was as if I found a new way to have an extra income, to achieve my financial freedom sooner. My path hit an obstacle shortly after because an ingredient was amiss, Patience.

It was 2014 when Kepland was delisted, refer here for my story. I was like why would I wait any longer since investment can earn more money? I executed my investment plan with more than 80% of my savings. I bought the banks, telcos, reits, which I thought it would be safer. I am holding growth and dividend stock, and these are companies with good and reputable stock with good track records, just buy and hold and wouldn't go wrong.

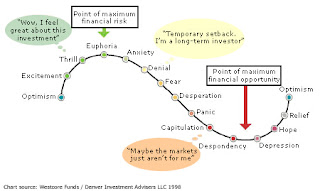

I bought all the way till Apr 2015, some may called it the euphoria stage of the market. As you had guessed, the "Oil Crisis".

STI dropped from high of 3500 to low near 2500, and most of my shares were bought when STI is around 3300. The best part is the news about entry of the 4th Telco in Singapore, hit the once "stable" telcos stocks heavily, especially M1. The telcos' prices dropped more than I had expected. Although I knew about the news since 2014, the market only affect the prices much in 2015 after I bought the telcos shares, am I unlucky?

Sometimes it is not about how good the company is, but is about when would you execute your plan to buy. Timing and of course luck plays a part.

Alternatively, one way to do this is do not buy all the shares at one shot, dont rush into the market. Buy them gradually over a period with strategically average up or average down at a percentage which you are comfortable with. Although companies maybe good, but we cant time it to get the best price, so average them out and buy them over a period may be a better choice.

Patience do plays in another point of view, because soon after I just learned that stock needs to be patience, I am glad that I didn't push the panic sell button. Although I'm still holding a red portfolio, at least it recovers over 10%+ with a two months. Guess I had more needs to learn.

Euphoria stage, market's mood as described by forbes article.

It was 2014 when Kepland was delisted, refer here for my story. I was like why would I wait any longer since investment can earn more money? I executed my investment plan with more than 80% of my savings. I bought the banks, telcos, reits, which I thought it would be safer. I am holding growth and dividend stock, and these are companies with good and reputable stock with good track records, just buy and hold and wouldn't go wrong.

I bought all the way till Apr 2015, some may called it the euphoria stage of the market. As you had guessed, the "Oil Crisis".

STI dropped from high of 3500 to low near 2500, and most of my shares were bought when STI is around 3300. The best part is the news about entry of the 4th Telco in Singapore, hit the once "stable" telcos stocks heavily, especially M1. The telcos' prices dropped more than I had expected. Although I knew about the news since 2014, the market only affect the prices much in 2015 after I bought the telcos shares, am I unlucky?

Sometimes it is not about how good the company is, but is about when would you execute your plan to buy. Timing and of course luck plays a part.

Alternatively, one way to do this is do not buy all the shares at one shot, dont rush into the market. Buy them gradually over a period with strategically average up or average down at a percentage which you are comfortable with. Although companies maybe good, but we cant time it to get the best price, so average them out and buy them over a period may be a better choice.

Patience do plays in another point of view, because soon after I just learned that stock needs to be patience, I am glad that I didn't push the panic sell button. Although I'm still holding a red portfolio, at least it recovers over 10%+ with a two months. Guess I had more needs to learn.

Euphoria stage, market's mood as described by forbes article.

Subscribe to:

Comments (Atom)