穷小子 not intending to blog about this initially, but there is something he must share. Attended the AGM yesterday, and OCBC's CEO shook hands with 穷小子. Wahaha!! Not that 穷小子 is some kind of VIP, but the shaking of hands is because Mr Tsien is courtesy and polite, and greeted us with a Good Afternoon. Is a simple gesture, but is the effort which he had made counts. Feels so appreciated when he says Good Afternoon and Thanks us for coming. He don't have to do so, but he did. Applause!!

He walked from the front row and to the walkway column, where 穷小子 is sitted, to shake hands with each of us. By the way, all of these were happened very early, 10 mins before the financial performance presentation starts, and very much before the AGM.

With the presentation of the financial performance start..

穷小子 had to admit that he got lost when CEO is presenting the annual financial performance, so wouldn't share much of that in details. 穷小子 is non-financial background after all. Lol.

CEO shared with us that oil price at $70 will be required for the Oil and Gas industry to break even, and $60 for the lenders to break even. To further supplement, CEO also mentioned that OCBC can't confirm if the worst for O&G is over, but pointing out that 2017 will be a better year than the year before.

A shareholder question about the status of the divestment of United Engineers, and will there be any special dividends after the divestment?

- CEO answered that it is premature to discuss on the divestment status right now.

Another shareholder pointed out that continuation of this news will demoralized the shareholders and the public. Is there any ways or methods which OCBC's management can assist or expedite on the progress?

- Although OCBC is a stakeholder of UE Limited, UE works as an individual entity and will leave the decisions to UE's management.

China is second largest contributor to the profits after Singapore.

and so the AGM begins...

Management commented that higher interest rates is good for banks generally.

Chairman commented that OCBC CEO's remuneration had the most reduction among the 3 banks' CEO.

Why is there no Scrip dividend? Another shareholder commented that it is disturbing that some years have and some do not, which resulted with odd shares remains.

- Chairman answered that OCBC is in a strong capital position. This decision allows them to deploy the cash productively, and secondly, scrip will caused the diluting of share prices.

Ironically, most of us want scrip. Hmm, does this means the company has many money lying around? If dividend payout without scrip options means that OCBC have many cash, so does that means OCBC have less cash if with scrip options, and which means bad for the company? Guess there is no one plus one kind of direct answer. Management had to review the company's capital position at the right time to decide whether to payout in scrip or not.

Can see that most of the shareholders are chanting, "We want Scrip! We want Scrip!" Very unlikely that there will be any scrip dividends for 2017 after hearing from Chairman and CEO.

A shareholder asked why isn't there any 80th anniversary special dividends? The same question was raised during the last AGM.

- Same answer. The management will review its capital at the right time and decide accordingly. Guess that means they had decided not to give.

On a second thought to this, if the capital review on the scrip dividend decided to pay out dividends in cash, then it is contradicting to the above as in why not use the capital to give special dividends? Hmm. Or at least increase the dividends, which 穷小子 is expecting an increase in dividend. This link to another question, but Chairman stated that we should be looking at the payout ratio. Is like egg first or chicken first. Haha. But anyway, the trust is still with the OCBC's directors and CEO, and believe their decisions are made based on the company's best interest.

There is no "hungry ghosts" in this year's AGM. The doors are open and all the "hungry ghosts" are allow to get their snacks sets before the AGM started. This prevented the ugly scene which was experience last year. The whole AGM is enjoyable until Resolution 4(b). A lady keep pressing questions on the diversity the director, e.g. gender, race, nationalities, etc. Chairman had answered them, but she keep pressing on. The lady is completely wasting everyone's time. What is the point of asking these questions? Are you planning to enter the Board of Directors?

As 穷小子 is leaving the AGM, he had decided that OCBC is safe with the management's hands, especially with CEO's spearheading the businesses' operations. Until then, see you in 2018.

穷小子

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Showing posts with label OCBC. Show all posts

Showing posts with label OCBC. Show all posts

Saturday, 29 April 2017

Wednesday, 3 August 2016

OCBC 2Q2016 Financial Results

To be a better value investor, first of all, should at least know how to analyst a financial results.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

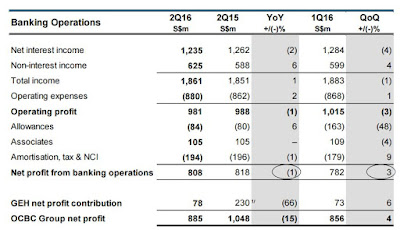

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

Next is we need to know how much is OCBC's insurance arm's weightage.

Next up to the concern in trend would be the Oil and Gas exposure.

Total exposure to Oil and Gas is S$14.3b, and out of which, the customer loans is only at 6%. If 穷小子 remember correctly, the CEO did says that this is negligible during the last AGM. At least there is no exposure to Swiber.

If only to put UK into account, it is only about 2.2% of total assets, which is negligible as well.

Was expecting to have a better payout ratio of at least 40% and a higher dividend at about $0.37-$0.38 for last year, but too bad. Well, at least they did increase the payout ratio for this time round, and didn't cut the dividend. Give and take for this.

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

|

| We can see that there is a great drop of 66% in Great Eastern profits contribution from last year. Shall not covers more about why Great Eastern profits drop since the concern here is about OCBC. |

Next is we need to know how much is OCBC's insurance arm's weightage.

|

| Insurance's weight at about 11% |

To 穷小子's simplest way of understand is that 11% of OCBC value will be totally wiped off if only there is a worst case scenario for Great Eastern. Guess that OCBC should be able to survive it, but of course, we are still far from seeing this to happen.

Next up to the concern in trend would be the Oil and Gas exposure.

|

| 6% of total customer loans |

Coming up next will be the exposure to the Brexit effects.

|

| Less than 3% of total assets |

Last but not least, let's look into the what 穷小子 interest in most, the dividend payout.

|

| Maintained dividend of $0.18 per share |

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

Wednesday, 15 June 2016

OCBC scrip dividend received today

This is a review post about OCBC Scrip dividend Scheme.

100 of OCBC shares from the payment of Scrip dividend was credited to 穷小子's CDP account today. Including this, it would be the third time 穷小子 had opted for Scrip Dividend Scheme.

The decision made in May to opt for shares has been right so far.

To recap, the scrip dividend price is $8.11, the price which is after the 10% discount from the determined price at $9.01.

If 穷小子 have opted for Cash dividend instead, he would have received $810.18 only, rather than the value of $845.00 today. Although it seems to be a difference of $34.82 only, it is actually an additional of 4.29%.

Moreover, this 100 of OCBC shares will be included in the formula for computing the next scrip dividend which usually falls on August, about two months from now on. Let it Grow! Let it Grow!

The power of Scrip dividend and Compounding effects.

100 of OCBC shares from the payment of Scrip dividend was credited to 穷小子's CDP account today. Including this, it would be the third time 穷小子 had opted for Scrip Dividend Scheme.

The decision made in May to opt for shares has been right so far.

To recap, the scrip dividend price is $8.11, the price which is after the 10% discount from the determined price at $9.01.

Dividend Announced

|

$0.18 per share

|

Cash dividend value

|

$810.18

|

Amount of shares received via Scrip Dividend

|

100

|

Determined Price for Scrip Dividend (after 10% discount)

|

$8.11

|

Scrip Dividend Price as of 28 Apr 2016

|

$811.00

|

Last Closed Price

|

$8.45

|

Scrip Dividend Price as of today

|

$845.00

|

|

| For anyone who needs the events timeline information |

Moreover, this 100 of OCBC shares will be included in the formula for computing the next scrip dividend which usually falls on August, about two months from now on. Let it Grow! Let it Grow!

The power of Scrip dividend and Compounding effects.

Thursday, 12 May 2016

OCBC Scrip Dividend Scheme

After waited for more than 2 weeks since XD date, have received the letter of notice for my scrip dividends from OCBC today. Finally.

What is scrip dividend?

Investopedia: A stock dividend is a dividend payment made in the form of additional shares, rather than a cash payout.

穷小子: Basically is payment to you by shares instead of cash for dividends.

From what I know, the 3 local pillar banks (DBS, OCBC, UOB) stocks may give their shareholders an option to choose between payment by shares or cash for each round of dividends payment. No, scrip dividend is not a mandatory for every year, it is a decision by the management and is one of the resolutions which the shareholders had to vote during the Annual General Meeting. In short, we wouldn't know whether the company would still have scrip dividend for next year until the next AGM.

How is the number of OCBC shares determined?

There is a formula for this actually. Using the amount of dividend (cash) which supposed to receive, divided by a 10% discount to the price which was determined during the price determination period, from 26 April 2016 to 28 April 2016 (both dates inclusive).

The price was determined at $9.01 for this round of dividend. which gives you a $8.11 after the 10% discount.

E.g. Supposing should you received $405.50 as cash dividend, you will have entitlement of 50 OCBC shares as scrip dividend scheme.

Should take up scrip dividend or cash dividend?

Let's weight some of the pros and cons which I can think of now if choose to receive in scrip dividend.

Pros

Errmm. One more Pros pointers for 穷小子. He was entitled 100 shares for this round of scrip dividend, no odd lots for this time.

What is scrip dividend?

Investopedia: A stock dividend is a dividend payment made in the form of additional shares, rather than a cash payout.

穷小子: Basically is payment to you by shares instead of cash for dividends.

From what I know, the 3 local pillar banks (DBS, OCBC, UOB) stocks may give their shareholders an option to choose between payment by shares or cash for each round of dividends payment. No, scrip dividend is not a mandatory for every year, it is a decision by the management and is one of the resolutions which the shareholders had to vote during the Annual General Meeting. In short, we wouldn't know whether the company would still have scrip dividend for next year until the next AGM.

How is the number of OCBC shares determined?

There is a formula for this actually. Using the amount of dividend (cash) which supposed to receive, divided by a 10% discount to the price which was determined during the price determination period, from 26 April 2016 to 28 April 2016 (both dates inclusive).

The price was determined at $9.01 for this round of dividend. which gives you a $8.11 after the 10% discount.

E.g. Supposing should you received $405.50 as cash dividend, you will have entitlement of 50 OCBC shares as scrip dividend scheme.

Should take up scrip dividend or cash dividend?

Let's weight some of the pros and cons which I can think of now if choose to receive in scrip dividend.

Pros

- The determined price is still lower than the market price, which is $8.33 as of today closed price.

- Although it became less than 2.5% discount instead of the 10% discount, we still had a free $0.22 per share from the scrip.

- Fractional entitlements to a hundredth of a share or more will be rounded up to the nearest whole share. E.g.

- 50.01 shares will be rounded up to 51,

- 50.009 shares will be rounded down to 50 shares. - Is a good method for compounding if you are looking it as a long term investment.

- Saves all the commissions and fees for the buying and selling transactions if one chooses to reinvest the dividend.

- The value of the shares from the scrip dividends may increase in future. So long the price is more than $8.11, it means is in paper profits already.

Cons

- No cash received, means no actual gain realised. Cash is King, some may say.

- It may no longer to be seen as a 10% discount, because of the market price is getting nearer to $8.11. Might as well take the cash first and plan for the next move.

- There will be odd lots in resulted, which may be inconvenient to sell in the market.

- The value of the shares from the scrip dividends may decrease in future. If the market price is less than $8.11, it is "eating" up the dividends, which means is in paper loss.

Scrip dividend or Cash dividend? You make the call.

This is the third time which I will opt for scrip dividend. Okie, I am bias, I can't think of much cons for this. It is a brown form this time instead of the green form which were received previously. Maybe because I had made a standing instruction for receiving scrip dividend as my permanent election for all my subsequent dividends until further notice.Errmm. One more Pros pointers for 穷小子. He was entitled 100 shares for this round of scrip dividend, no odd lots for this time.

Subscribe to:

Comments (Atom)