After I believed in Value investing, it was as if I found a new way to have an extra income, to achieve my financial freedom sooner. My path hit an obstacle shortly after because an ingredient was amiss, Patience.

It was 2014 when Kepland was delisted, refer here for my story. I was like why would I wait any longer since investment can earn more money? I executed my investment plan with more than 80% of my savings. I bought the banks, telcos, reits, which I thought it would be safer. I am holding growth and dividend stock, and these are companies with good and reputable stock with good track records, just buy and hold and wouldn't go wrong.

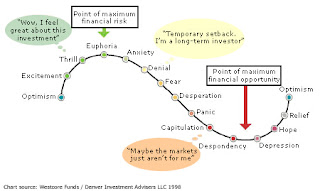

I bought all the way till Apr 2015, some may called it the euphoria stage of the market.

As you had guessed, the "Oil Crisis".

STI dropped from high of 3500 to low near 2500, and most of my shares were bought when STI is around 3300.

The best part is the news about entry of the 4th Telco in Singapore, hit the once "stable" telcos stocks heavily, especially M1. The telcos' prices dropped more than I had expected. Although I knew about the news since 2014, the market only affect the prices much in 2015 after I bought the telcos shares, am I unlucky?

Sometimes it is not about how good the company is, but is about when would you execute your plan to buy. Timing and of course luck plays a part.

Alternatively, one way to do this is do not buy all the shares at one shot, dont rush into the market. Buy them gradually over a period with strategically average up or average down at a percentage which you are comfortable with. Although companies maybe good, but we cant time it to get the best price, so average them out and buy them over a period may be a better choice.

Patience do plays in another point of view, because soon after I just learned that stock needs to be patience, I am glad that I didn't push the panic sell button. Although I'm still holding a red portfolio, at least it recovers over 10%+ with a two months. Guess I had more needs to learn.

Euphoria stage, market's mood as described by forbes article.

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Wednesday, 27 April 2016

Monday, 25 April 2016

About Myself (3/3)

Path towards value investor

Ironically, while "trading" Kepland, I began my path towards Value Investor. How's that so? It was when Kepland announced to be delisted. The summarized story goes "if I had hold my Kepland shares for 2 more trading days, I would be $5,000 richer". At that point of time, I had 5 lots (1000 per lot), but I sold all of them 2 days before the news was announced. The offered price was about $1 per share more than my purchased price.Q: What does it had to do with Value Investor?

A: Erm, if I had follow the news closely, I may have heard about the rumors about KepCorp takover and hence will not sell them.

Q: But this is not Value Investor definition. It is not about rumours or news.

A: Hmm, if I am a value investor belief, I may have buy and hold all the way. Afterall, value investor is all about buy and hold methodology.

You may argue that Kepland may not be "good enough" for the "buy and hold" methodology. My logic is simple, since Kepcorp choose to takeover Kepland just when oil crisis about to erupt, this shows how much confidence they had in Kepland, and it may be their cash-cow to ride through the oil crisis.

It may not be the best stock, but it should be a "good enough" stock for a value investor, or for me at least.

I may not be a value investor cause my Fundamentals Analysis is not good, but I believe in buy and hold methodology, and by my own concepts.

P.S. At least, I know what is P/E, P/B, BVPS, Dividend Yield, etc now.

About Myself (2/3)

Luck runs out

Of course I made few bad choices during these 2 years. My major losses, with some still holding till even today,- A local penny stock suspended till today

- Semb Mar bought almost at its all time high, $5.3x

NOL at $2.2xNoble at $2.1x- US

Fannie Maehave to cut lost due to it submitted the pink sheets

About Myself (1/3)

It was in Apr 2009 when I bought my first share. Yes, it was the time when the market was recovering from the Global Financial Crisis (GFC). I knew nothing about it, but only with one good idea, buy low - sell high.

I had about $6,000 from my savings and about $4,000 as "second batch" funds to starts off with it. I am looking for a volatile stock and with a recognizable good reputation company at that time. With limited or close to no knowledge in this, I only know Capitaland from my shopping experience, and it became my first stock.

I was lucky enough, or you could say is beginner's luck. Basically in short, it was like buy what huat what at that time. I managed to make $400 for that week. Since then, it became "addictive", and to a certain extend that I made at least 2 transactions per month for the year 2010, from contra to naked short, I had tried all those. And with that, it was when I began to buy US stocks as well with big names such as Las Vegas, MGM, Citibank, etc. By the end of 2010, despite having small losses from time to time, I managed to make a profit of $10,000.

I was lucky enough, or you could say is beginner's luck. Basically in short, it was like buy what huat what at that time. I managed to make $400 for that week. Since then, it became "addictive", and to a certain extend that I made at least 2 transactions per month for the year 2010, from contra to naked short, I had tried all those. And with that, it was when I began to buy US stocks as well with big names such as Las Vegas, MGM, Citibank, etc. By the end of 2010, despite having small losses from time to time, I managed to make a profit of $10,000.

Subscribe to:

Comments (Atom)