The month of July and August, the second half of dividend collection! Let's have a portfolio update.

穷小子's portfolio update:

For the period of these two months, 穷小子 will be receiving a total of S$1,755.55 in dividends.

Dividends received this round: S$1,755.55

Year 2016

Total dividends: S$3,552.70

Average dividends per month: S$444.09

Average dividends per day: S$14.56

穷小子 still trying hard to increase his dividend yield for his portfolio. Although did mention that was trying to get REITS in his portfolio, still didn't manage to do so. FCT did have a sudden drop at June, but didn't notice that that day, and it recovers fast and furious subsequently. Maybe will have a chance again when rate hikes. Anyway, got FCL instead.

Been 3 weeks since the last post due to Pokemon fever. Hehe~

I decided to start this blog to remind myself on how much I had learned investing through the hard way. I don't have a strong finance background, but wish to achieve financial freedom by investing. Perhaps most of my stocks-picking are based on my own logics and concepts which I had learned. My belief is 穷小子日记, I may be poor in appearance, but rich in pocket and knowledge, and it’s all that matters.

Wednesday, 31 August 2016

Wednesday, 3 August 2016

OCBC 2Q2016 Financial Results

To be a better value investor, first of all, should at least know how to analyst a financial results.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

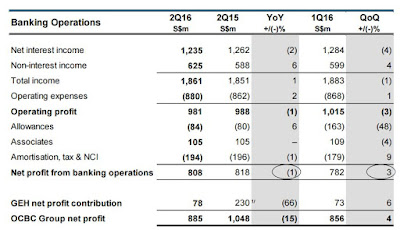

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

Next is we need to know how much is OCBC's insurance arm's weightage.

Next up to the concern in trend would be the Oil and Gas exposure.

Total exposure to Oil and Gas is S$14.3b, and out of which, the customer loans is only at 6%. If 穷小子 remember correctly, the CEO did says that this is negligible during the last AGM. At least there is no exposure to Swiber.

If only to put UK into account, it is only about 2.2% of total assets, which is negligible as well.

Was expecting to have a better payout ratio of at least 40% and a higher dividend at about $0.37-$0.38 for last year, but too bad. Well, at least they did increase the payout ratio for this time round, and didn't cut the dividend. Give and take for this.

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

As mentioned in all the previous posts, 穷小子 admitted that he is not a great Financial Analyst. Decided to do a simple analyst and shall use OCBC's first half of the year results for a start, since OCBC took up a majority of 穷小子's portfolio. Please advise/correct him there is any misinformation. Thanks.

Believed that most of the broker's research reports and fellow bloggers should have covered pretty much already. Hence, shall not covers too much about the details, but only touch on the areas which 穷小子 is more concern about instead.

News headlines would says "Net profit of S$885m was 15% lower YoY; but 4% higher QoQ". Most of the news says it is drag down by its insurance arm, Great Easter's earnings. Actually why is it so? Is it good or bad? 穷小子 do not have a definite answer for now, perhaps need to wait for the annual report to see if there is any improvement before suggesting further.

|

| We can see that there is a great drop of 66% in Great Eastern profits contribution from last year. Shall not covers more about why Great Eastern profits drop since the concern here is about OCBC. |

Next is we need to know how much is OCBC's insurance arm's weightage.

|

| Insurance's weight at about 11% |

To 穷小子's simplest way of understand is that 11% of OCBC value will be totally wiped off if only there is a worst case scenario for Great Eastern. Guess that OCBC should be able to survive it, but of course, we are still far from seeing this to happen.

Next up to the concern in trend would be the Oil and Gas exposure.

|

| 6% of total customer loans |

Coming up next will be the exposure to the Brexit effects.

|

| Less than 3% of total assets |

Last but not least, let's look into the what 穷小子 interest in most, the dividend payout.

|

| Maintained dividend of $0.18 per share |

Another disappointing factor is that there is no scrip dividend for this time round, although did mentioned that this is up to the management decision.

Assuming based on today's XD closing price at $8.35, a rough calculation would means that the scrip price should be at least below the current book value. 穷小子 always loves the scrip dividend when the price is low.

Conclusion

It seems that only Great Eastern's profits contribution is the only one which signal the minor red flag here. Both Oil & Gas and Brexit concerns can be negligible. No changes to the strategy, will continue to hold this for a very long term, and in fact, looking at an opportunity to buy when the price is 0.90x of the book value.

Subscribe to:

Comments (Atom)